產(chǎn)品展示

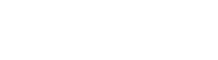

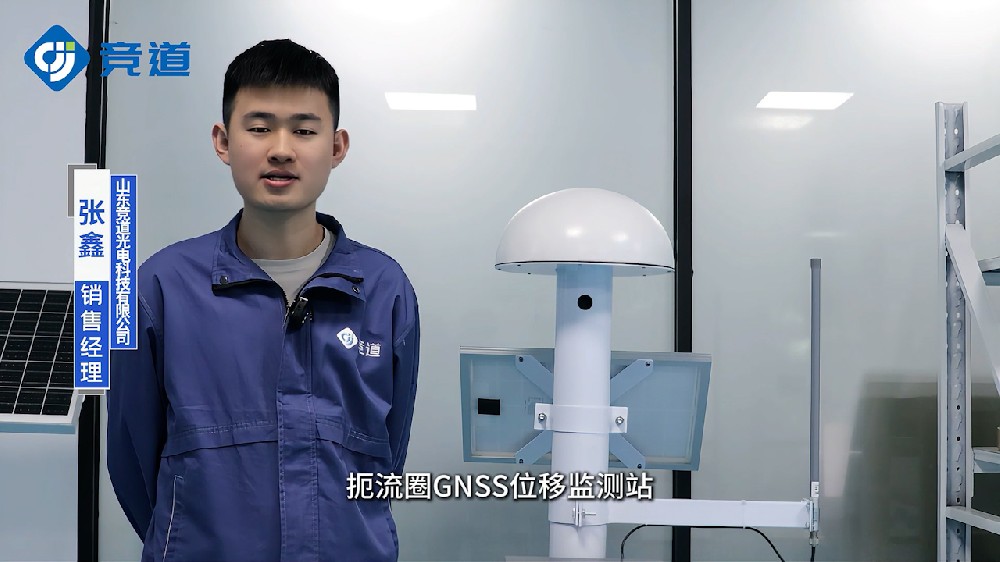

- GNSS監(jiān)測站

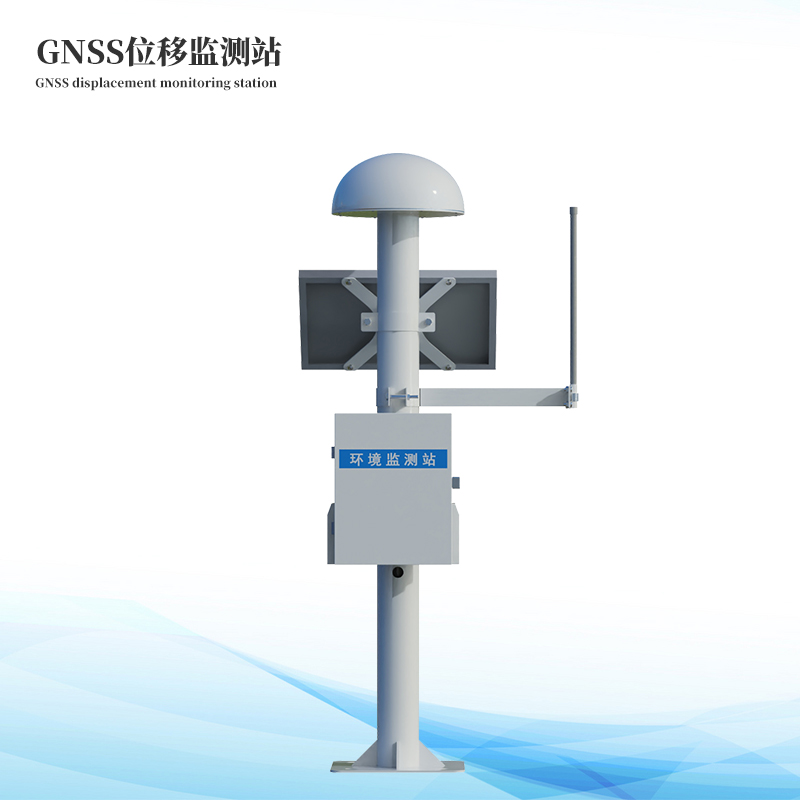

- 滲壓滲流監(jiān)測站

- 地質(zhì)災(zāi)害監(jiān)測儀

- 尾礦庫位移監(jiān)測站

- 位移監(jiān)測儀

- 裂縫監(jiān)測站

- 降雨量監(jiān)測站

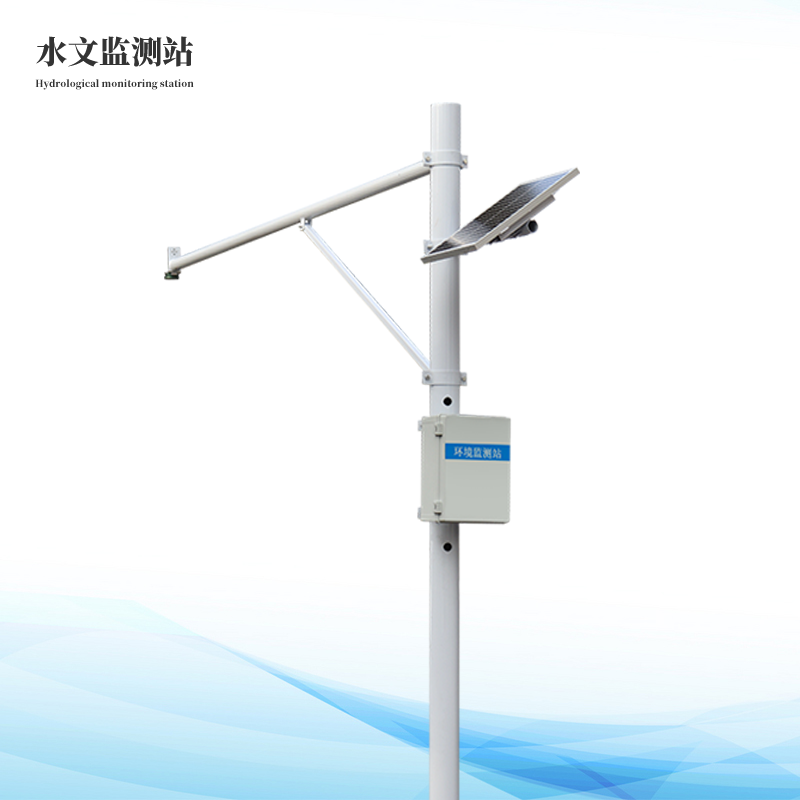

- 水庫水位監(jiān)測站

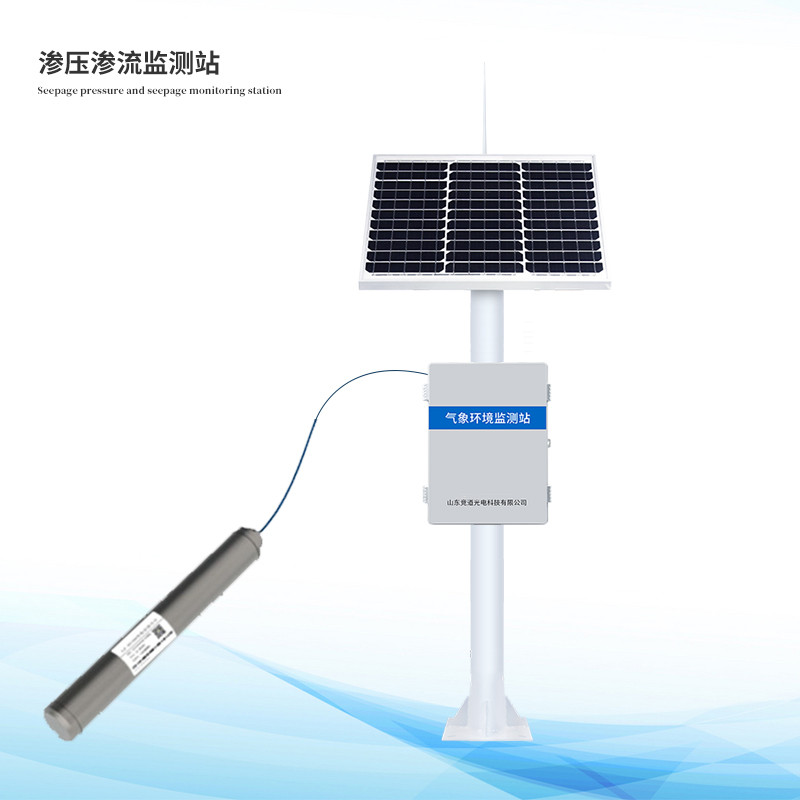

- 地下水位監(jiān)測站

- 水土流失監(jiān)測

- 余震監(jiān)測儀

- 爆破振動儀

- 道路橋梁安全監(jiān)測

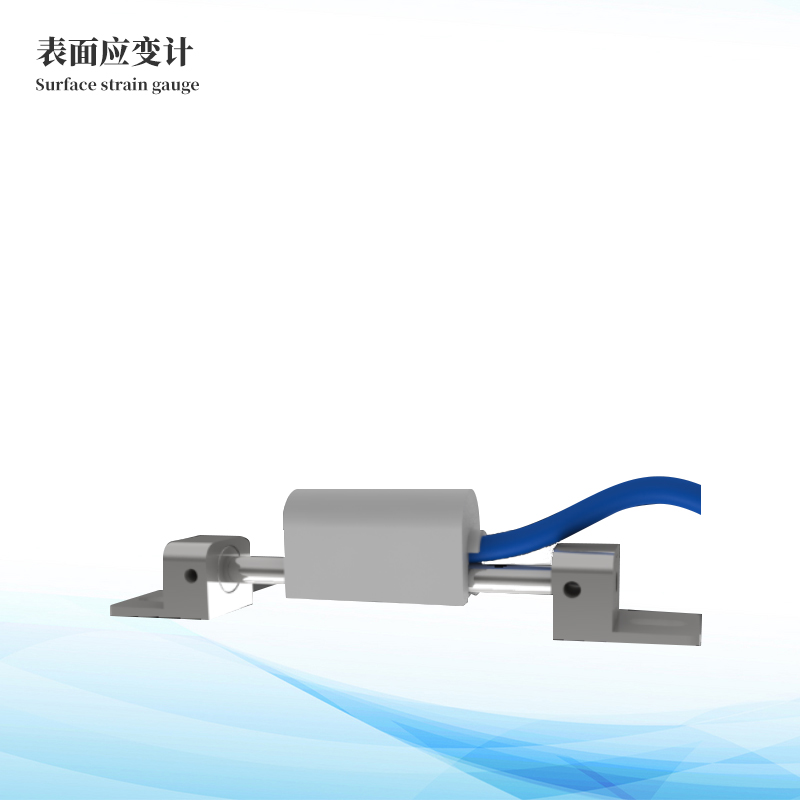

- 應(yīng)力應(yīng)變監(jiān)測儀器

- 測斜儀

- 傾角計

- 位移計

- 水準(zhǔn)儀

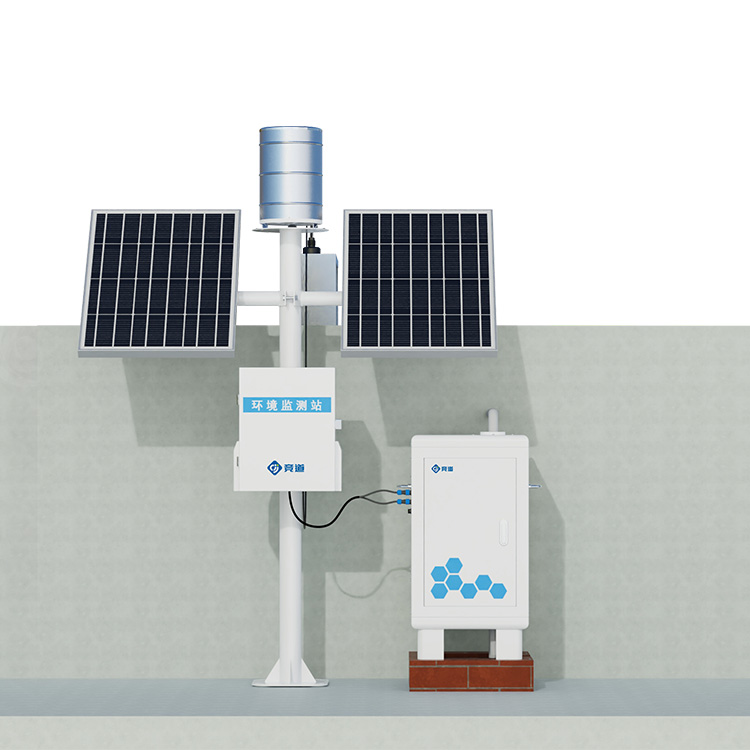

- 風(fēng)蝕氣象站

- 數(shù)據(jù)采集儀

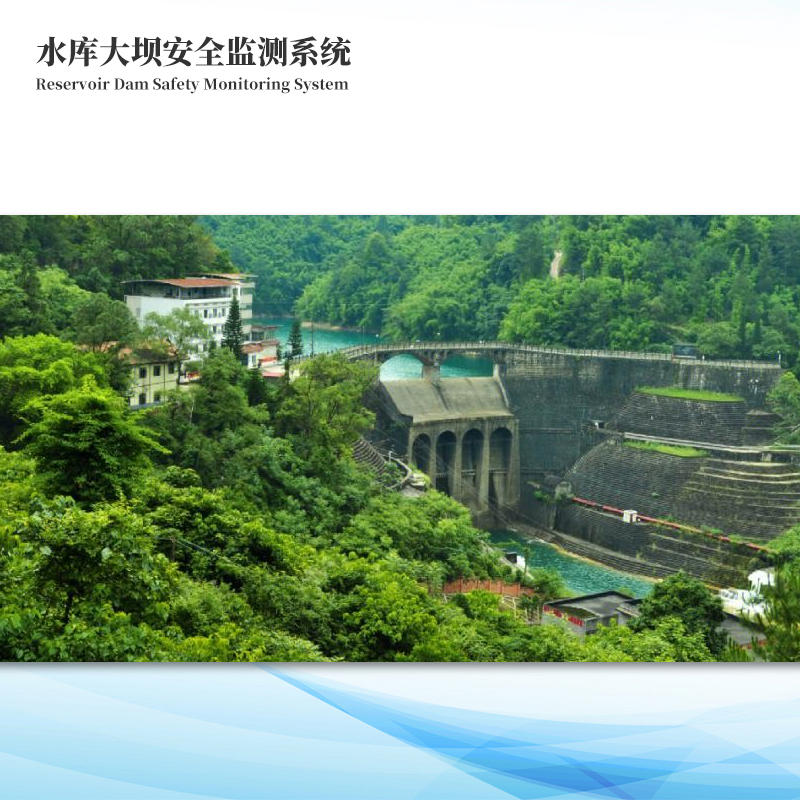

做高質(zhì)量水庫大壩安全監(jiān)測系統(tǒng)領(lǐng)導(dǎo)品牌

解決方案

多維度深度參與上下游產(chǎn)業(yè),積淀全面、專業(yè)的品牌實力,成就值得用戶放心托付的系統(tǒng)解決方案服務(wù)商

- more+應(yīng)用領(lǐng)域

- more+解決方案

- more+監(jiān)測設(shè)備

- more+客戶應(yīng)用案例

-

水庫大壩滲壓滲流監(jiān)測解決方案

+水庫大壩滲壓滲流監(jiān)測解決方案

水庫大壩滲壓滲流監(jiān)測

+ -

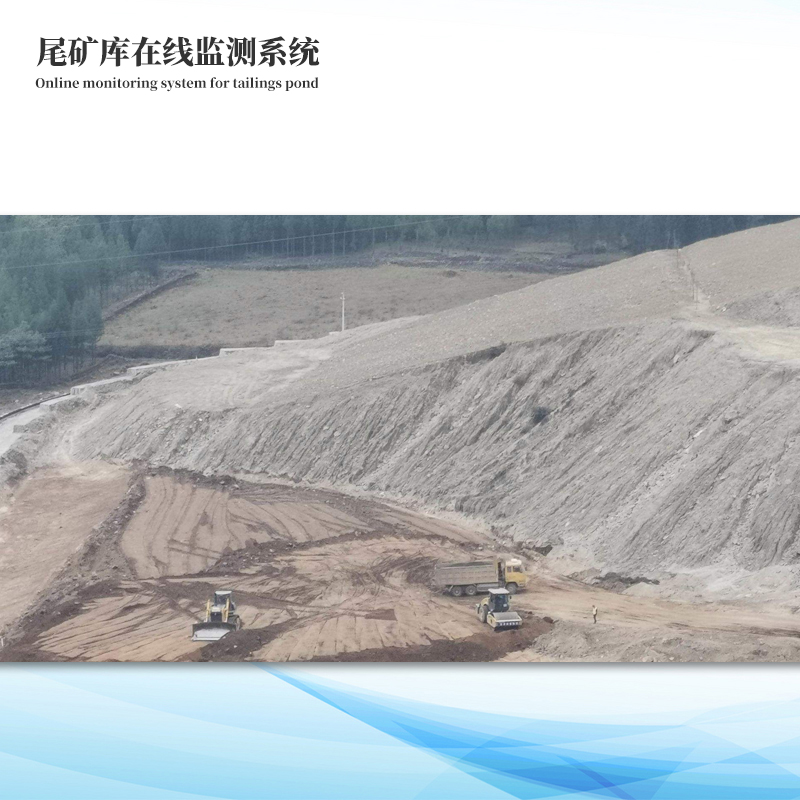

尾礦庫在線監(jiān)測系統(tǒng)解決方案

+尾礦庫在線監(jiān)測系統(tǒng)解決方案

尾礦庫在線監(jiān)測系統(tǒng)是利用傳感器技術(shù)、信號傳輸技術(shù)、網(wǎng)絡(luò)技術(shù)和軟件技術(shù),從宏觀、微觀相結(jié)合的全方位角度···

+ -

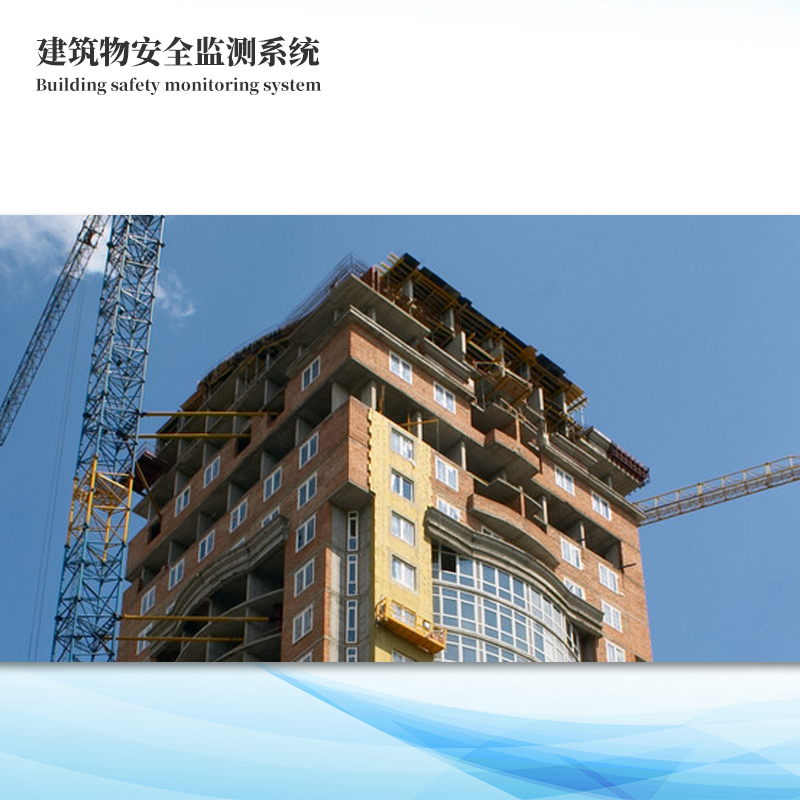

建筑物在線監(jiān)測系統(tǒng)解決方案

+建筑物在線監(jiān)測系統(tǒng)解決方案

建筑物在線監(jiān)測系統(tǒng)通過在建筑上安裝先進(jìn)監(jiān)測傳感器,實時動態(tài)監(jiān)測高層建筑物的傾斜、沉降、風(fēng)速風(fēng)向、裂縫···

+ -

基坑監(jiān)測系統(tǒng)解決方案

+基坑監(jiān)測系統(tǒng)解決方案

基坑監(jiān)測系統(tǒng)基于云計算服務(wù)中心的監(jiān)測系統(tǒng)可容納上萬個橋梁、隧道、邊坡等結(jié)構(gòu)物的監(jiān)測數(shù)據(jù),形成區(qū)域性結(jié)···

+ -

地鐵在線監(jiān)測系統(tǒng)解決方案

+地鐵在線監(jiān)測系統(tǒng)解決方案

地鐵在線監(jiān)測系統(tǒng)基于物聯(lián)網(wǎng)、云計算和大數(shù)據(jù)等技術(shù)的緊密結(jié)合,利用“互聯(lián)網(wǎng) +”在地鐵監(jiān)測中的創(chuàng)新應(yīng)用···

+ -

邊坡在線監(jiān)測解決方案

+邊坡在線監(jiān)測解決方案

年來,邊坡安全事件頻發(fā),為及時了解邊坡運營情況,對突發(fā)事故進(jìn)行提前預(yù)警,對邊坡安全監(jiān)測已經(jīng)迫在眉睫!···

+

關(guān)于我們

山東競道光電科技有限公司是水庫大壩安全監(jiān)測設(shè)備生產(chǎn)廠家,生產(chǎn)的GNSS監(jiān)測站精度好,滲壓滲流監(jiān)測站穩(wěn)定性好,水庫雨量水位監(jiān)測站價格優(yōu)惠,為用戶提供水庫大壩安全監(jiān)測產(chǎn)品及整體解決方案服務(wù)。山東競道光電科技有限公司在水庫大壩安全監(jiān)測設(shè)備領(lǐng)域具有多年的經(jīng)驗,有著完善的產(chǎn)品研發(fā)團(tuán)隊、 流水線式生產(chǎn)團(tuán)隊、售后服務(wù)團(tuán)隊。 競道光電科技堅持以市場為導(dǎo)向,以質(zhì)量為根本的原則,為用戶提供高質(zhì)量的設(shè)備。

查看更多 企業(yè)成長

企業(yè)成長 研發(fā)能力

研發(fā)能力 售后服務(wù)

售后服務(wù)

專注大壩安全監(jiān)測、水庫水雨情、地質(zhì)災(zāi)害監(jiān)測設(shè)備

追求卓越無止境 與時俱進(jìn)創(chuàng)未來

積極了解客戶需求,努力打造產(chǎn)品質(zhì)量,真誠提供滿意服務(wù),滿足用戶“系列化、價值化、規(guī)范化、專業(yè)化、差異化”的各種服務(wù)。

聯(lián)系我們新聞資訊

-

雷達(dá)水位監(jiān)測站助力水庫水位監(jiān)測

2025-11-05 -

水庫雨量監(jiān)測使用光學(xué)雨量監(jiān)測站

2025-11-05 -

地表裂縫監(jiān)測站在邊坡地質(zhì)災(zāi)害預(yù)警中的作用

2024-11-19 -

山東競道光電大壩GNSS監(jiān)測站廠家

2024-10-25

-

GNSS監(jiān)測站在地質(zhì)災(zāi)害監(jiān)測中的作用

GNSS監(jiān)測站?能夠全天不間斷的對地表進(jìn)行監(jiān)測,監(jiān)測中心通過監(jiān)測數(shù)據(jù)可以掌握地質(zhì)地表的狀況,一旦出現(xiàn)有異常狀況,管理人員···

- 12-122025

-

大壩滲流監(jiān)測系統(tǒng)在大壩安全管理中作用介紹

大壩滲流監(jiān)測系統(tǒng)是推出的一款大壩安全監(jiān)測設(shè)備,該設(shè)備的使用能夠為大壩安全管理工作提供助力。

- 12-112025

-

滲壓滲流監(jiān)測站在大壩管理中的使用

滲壓滲流監(jiān)測站是一款用于實時監(jiān)測坡體不同地質(zhì)層面滲流滲水壓力。滲壓滲流監(jiān)測站是可以使用到大壩安全監(jiān)測工作中的。

- 12-112025

-

gnss自動位移監(jiān)測站在礦山安全管理中的作用

gnss自動位移監(jiān)測站?作為一款能夠?qū)崟r精準(zhǔn)監(jiān)測地表沉降位移的設(shè)備,在安全管理中發(fā)揮了重要作用。

- 12-102025