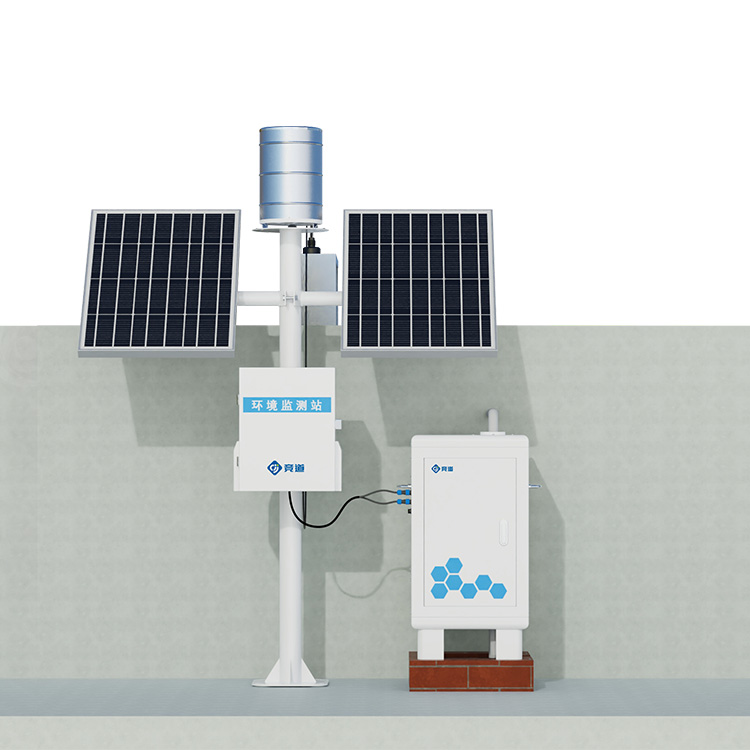

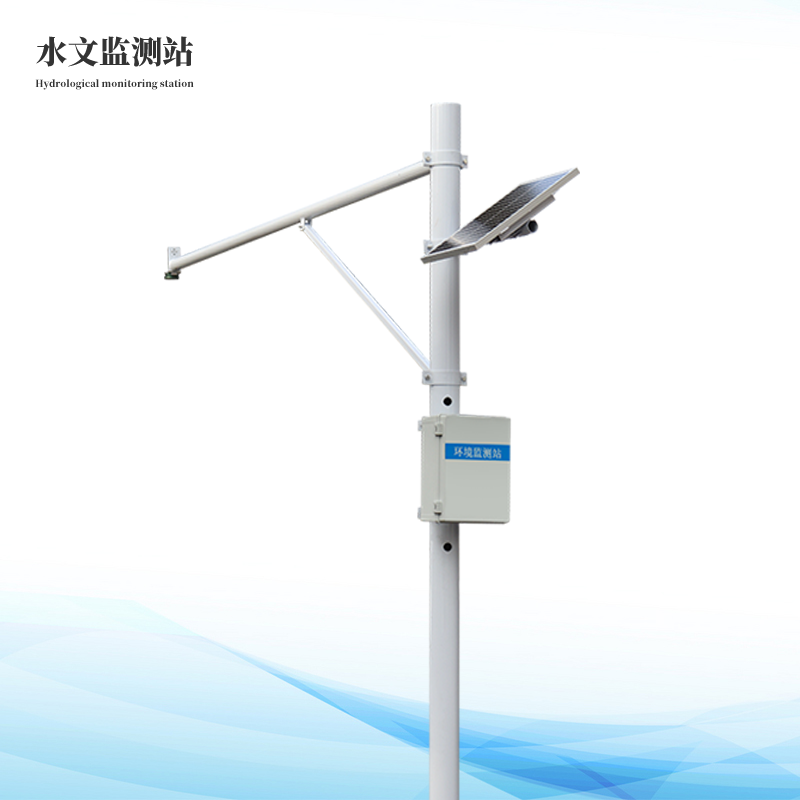

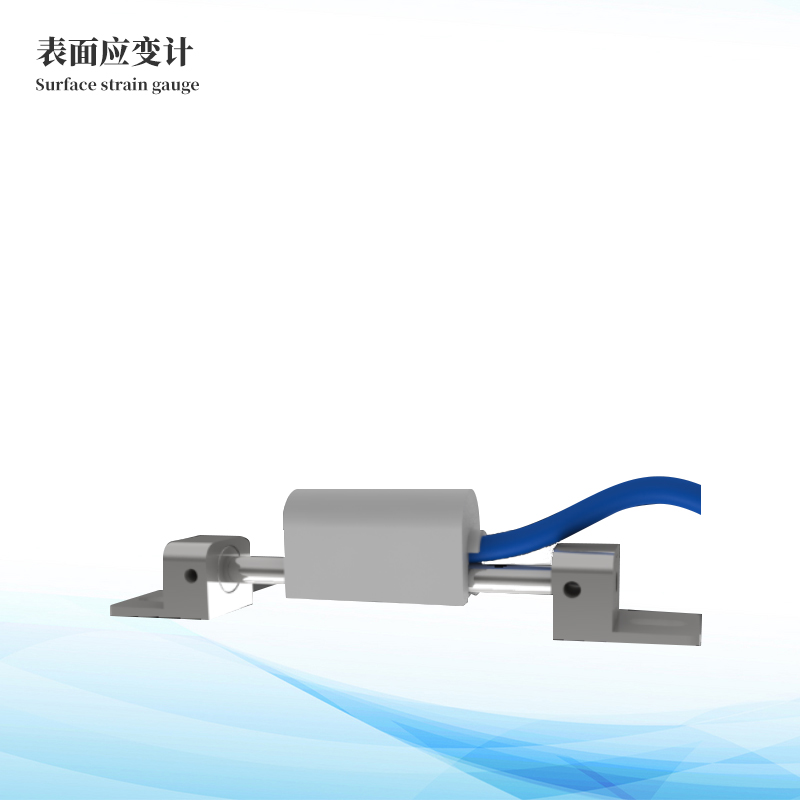

產品展示

做高質量水庫大壩安全監測系統領導品牌

解決方案

多維度深度參與上下游產業,積淀全面、專業的品牌實力,成就值得用戶放心托付的系統解決方案服務商

- more+應用領域

- more+解決方案

- more+監測設備

- more+客戶應用案例

-

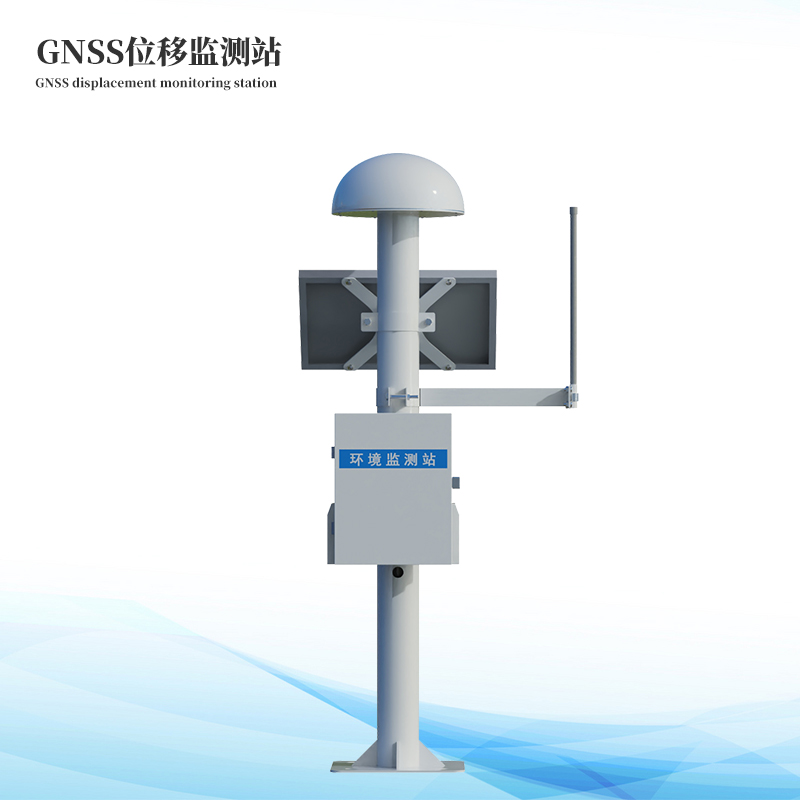

水庫大壩滲壓滲流監測解決方案

+水庫大壩滲壓滲流監測解決方案

水庫大壩滲壓滲流監測

+ -

尾礦庫在線監測系統解決方案

+尾礦庫在線監測系統解決方案

尾礦庫在線監測系統是利用傳感器技術、信號傳輸技術、網絡技術和軟件技術,從宏觀、微觀相結合的全方位角度···

+ -

建筑物在線監測系統解決方案

+建筑物在線監測系統解決方案

建筑物在線監測系統通過在建筑上安裝先進監測傳感器,實時動態監測高層建筑物的傾斜、沉降、風速風向、裂縫···

+ -

基坑監測系統解決方案

+基坑監測系統解決方案

基坑監測系統基于云計算服務中心的監測系統可容納上萬個橋梁、隧道、邊坡等結構物的監測數據,形成區域性結···

+ -

地鐵在線監測系統解決方案

+地鐵在線監測系統解決方案

地鐵在線監測系統基于物聯網、云計算和大數據等技術的緊密結合,利用“互聯網 +”在地鐵監測中的創新應用···

+ -

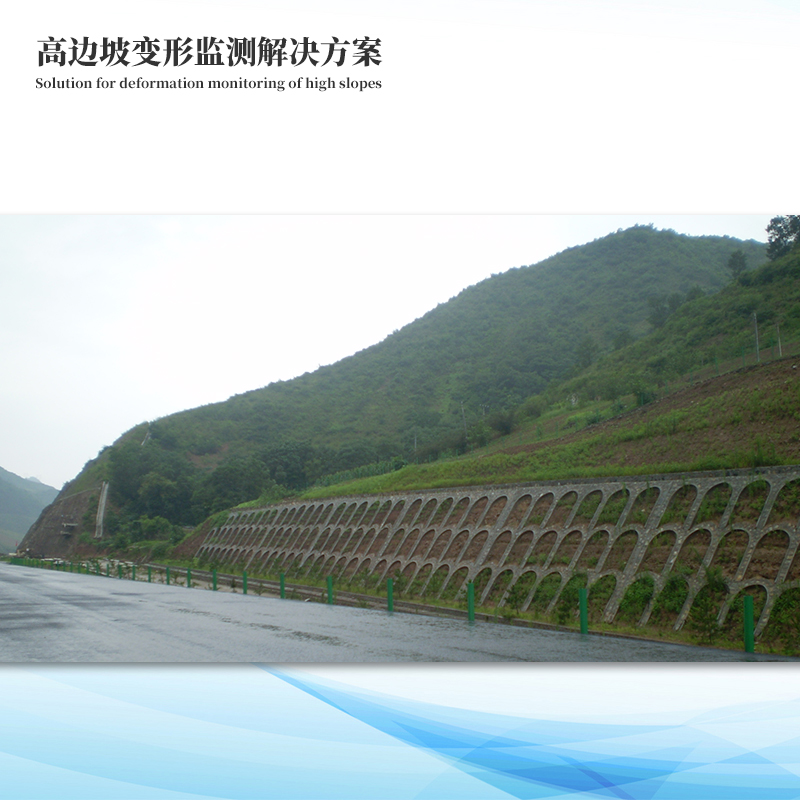

邊坡在線監測解決方案

+邊坡在線監測解決方案

年來,邊坡安全事件頻發,為及時了解邊坡運營情況,對突發事故進行提前預警,對邊坡安全監測已經迫在眉睫!···

+

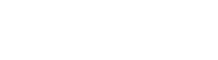

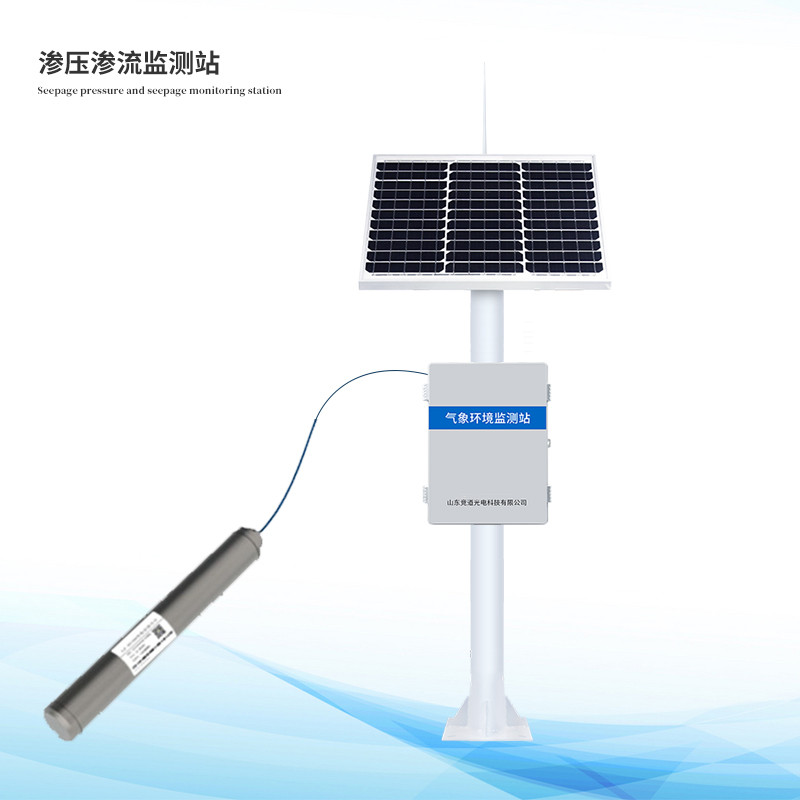

關于我們

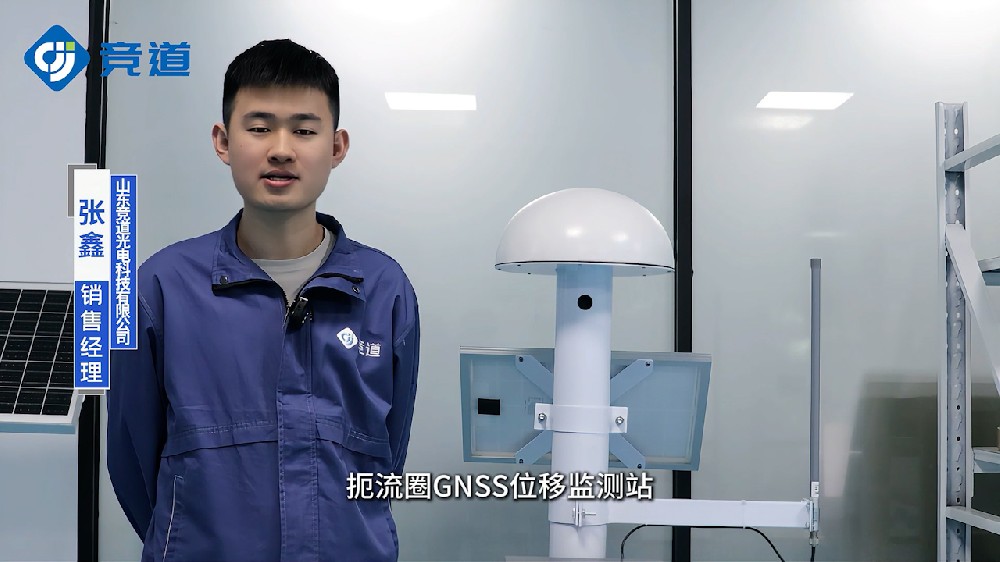

山東競道光電科技有限公司是水庫大壩安全監測設備生產廠家,生產的GNSS監測站精度好,滲壓滲流監測站穩定性好,水庫雨量水位監測站價格優惠,為用戶提供水庫大壩安全監測產品及整體解決方案服務。山東競道光電科技有限公司在水庫大壩安全監測設備領域具有多年的經驗,有著完善的產品研發團隊、 流水線式生產團隊、售后服務團隊。 競道光電科技堅持以市場為導向,以質量為根本的原則,為用戶提供高質量的設備。

查看更多 企業成長

企業成長 研發能力

研發能力 售后服務

售后服務

專注大壩安全監測、水庫水雨情、地質災害監測設備

追求卓越無止境 與時俱進創未來

積極了解客戶需求,努力打造產品質量,真誠提供滿意服務,滿足用戶“系列化、價值化、規范化、專業化、差異化”的各種服務。

聯系我們